By 2028, the biggest drug in the world could lose its patent protection-and with it, the chance for patients and insurers to save billions. That drug is Keytruda, Merck’s cancer immunotherapy that brought in $25.5 billion in sales in 2024 alone. But it’s not alone. A wave of blockbuster biologics, from Humira to Eylea, are hitting patent cliffs over the next five years, opening the door for biosimilars to enter the market in ways we’ve never seen before.

What Exactly Are Biosimilars?

Biosimilars aren’t generics. That’s the first thing to understand. Generics are exact copies of small-molecule drugs like aspirin or metformin. Biosimilars are highly similar versions of complex biological drugs-proteins made from living cells. Think monoclonal antibodies, vaccines, or hormone therapies. These aren’t made in a lab with chemicals; they’re grown in bioreactors using human or animal cells. Even tiny changes in the process-temperature, pH, cell line-can alter the final product. The FDA requires biosimilars to show no clinically meaningful differences in safety, purity, or potency compared to the original. That means extensive testing: thousands of analytical tests, animal studies, and often clinical trials. It’s not a shortcut. It’s a marathon. And it costs $150-250 million per product to get there.The Patent Cliff: $200 Billion at Stake

Between 2025 and 2030, over $200 billion in annual global sales for biologics will lose patent protection. That’s not a guess. It’s from Clival’s 2024 analysis. The biggest names are falling one by one:- Eylea (aflibercept) - $5.9 billion in U.S. sales in 2023. Patents expired in 2025. Three biosimilars-Yesafili, Opuviz, and Enzeevu-were approved in 2024. By Q1 2025, they already held 12% of the market.

- Enbrel (etanercept) - Patent expired in 2023. Sandoz’s biosimilar launched at a 35% discount. Now it’s the most prescribed version in many U.S. hospitals.

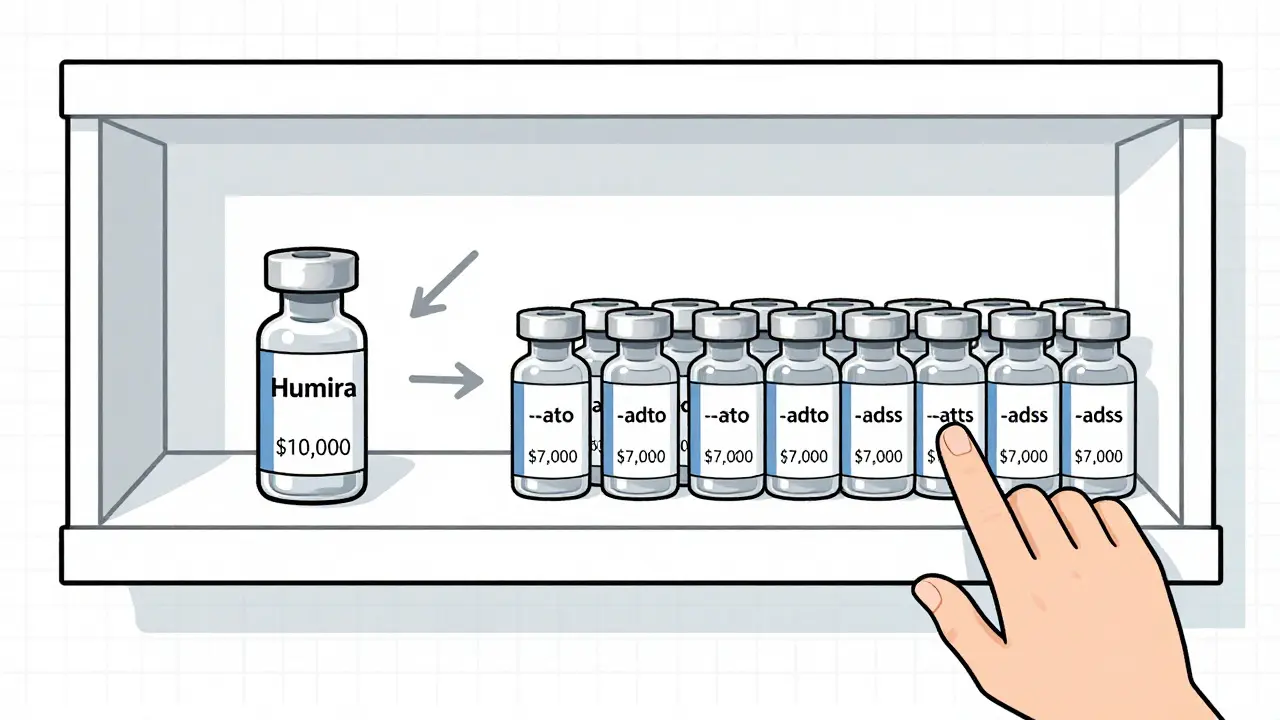

- Humira (adalimumab) - Once the world’s top-selling drug. Its patents expired in 2023. Twelve biosimilars are now approved. In 18 months, they captured 80% of new prescriptions.

- Keytruda (pembrolizumab) - The giant. Patents expire in 2028. Fourteen companies are already in Phase 3 trials. This could be the biggest biosimilar entry in history.

Why Is Keytruda Such a Big Deal?

Keytruda treats more than 20 types of cancer. It’s used in lung, melanoma, breast, and head and neck cancers. It’s not just a drug-it’s part of standard care for millions. That’s why its biosimilar entry in 2028 will be watched like a stock market crash. But here’s the catch: Merck didn’t make it easy. They built a patent thicket-237 patents, some stretching to 2035. Some are for delivery methods, others for dosing schedules. The FDA has to sort through them. That’s why, even though the core patent expires in 2028, some biosimilars might still face legal delays. Meanwhile, companies like Coherus BioSciences and Alvotech are racing to get their versions approved. Regeneron even partnered with Alvotech in January 2025 to co-develop biosimilars for Eylea. Big pharma is no longer just defending its turf-it’s getting into the biosimilar game too.

Market Entry Is Not the Same Everywhere

Europe adopted biosimilars fast. Why? Because payers forced the issue. In the EU, reimbursement rules favor lower-cost options. For some drugs, biosimilar use exceeds 70%. In the U.S., it’s slower. Only 30-40% for most products. The reason? Money flows backward. Medicare Part B pays providers based on the drug’s average sales price (ASP). If a doctor gives a $10,000 reference drug, they get reimbursed more than if they give a $7,000 biosimilar. That creates a financial incentive to stick with the original-even if the biosimilar is just as safe. Hospitals are fighting back. Kaiser Permanente now mandates biosimilar substitution for all new filgrastim prescriptions. Mass General Brigham saw biosimilar use jump from 12% to 68% after implementing similar rules. Payers like Cigna and Centene now offer $0 copays for biosimilars versus $50 for the brand. That’s changing behavior fast.Manufacturing Is the Hidden Hurdle

You can’t just copy a biologic like you copy a pill. These drugs are made from living cells. Even a slight shift in temperature during fermentation can change the sugar chains (glycosylation) attached to the protein. For Keytruda, those sugar chains are critical for how the immune system responds. If they’re off-even a little-the drug might not work as well. That’s why Samsung Bioepis spent $450 million on a single facility in Incheon, South Korea, built just for biosimilar production. Every step is tracked, validated, and documented. The FDA inspects these facilities like they’re nuclear plants. One misstep, and the whole batch is scrapped. And it’s not just the drug. Packaging, storage, labeling-all have to match. Biosimilars can’t be stored at room temperature if the original can’t. They need the same syringe type, same needle size, same shelf life.Real-World Outcomes: Are They Really the Same?

Patients and doctors are watching closely. At the American Society of Clinical Oncology in 2024, Dr. Laura Chow reported no difference in outcomes between Humira and its biosimilars in inflammatory bowel disease patients. That’s reassuring. But Dr. Richard Pazdur from the FDA’s Oncology Center documented cases where patients switching between rituximab biosimilars and the original had unexpected immune reactions. Not common. But enough to make clinicians cautious. Patient surveys show 78% are happy with the cost savings. But 34% are confused about whether they’re getting the biosimilar or the original. Pharmacists at CVS Caremark say prior authorization denials dropped 22% for biosimilars in 2025-proof that insurers are getting better at approving them. But academic medical centers still struggle to track long-term outcomes across multiple biosimilar brands.

The Future: Faster, Cheaper, More Complex

The FDA approved 17 biosimilars in 2024-up from just 5 in 2020. That’s a 240% increase in four years. And the pipeline is crowded: 412 biosimilar candidates are now in development targeting 87 reference products. The next wave won’t just be antibodies. It’ll be antibody-drug conjugates, fusion proteins, and complex cell therapies. The FDA’s 2025 draft guidance on “Analytical Similarity for Highly Complex Biologics” is trying to keep up. It’s not just about matching the molecule anymore. It’s about matching how it behaves in the body. Meanwhile, consolidation is happening. Sandoz bought Biocon’s biosimilars business for $3.9 billion in 2024. Viatris, the joint venture between Pfizer and Mylan, is now a major biosimilar player. The market leader? Sandoz, with 28% share.What This Means for Patients and Providers

If you’re on a biologic today-whether it’s for arthritis, psoriasis, or cancer-your options are about to expand. You may be switched to a biosimilar without asking. That’s legal in many states now, thanks to interchangeability designations. The FDA has approved 12 interchangeable biosimilars as of December 2025. That means pharmacists can swap them without consulting your doctor. But here’s the advice: Don’t panic. The data is clear: for most patients, biosimilars work just as well. Ask your doctor if your drug has a biosimilar. Check the FDA’s Purple Book-it’s updated daily. Ask your insurer what’s covered. You might save hundreds-or thousands-per year. And if you’re a provider? Start preparing now. Update your EHR systems. Train your staff. Know the differences between biosimilars. Track outcomes. This isn’t the future. It’s happening right now.What’s Next?

The next 18 months will be critical. Eylea biosimilars will keep gaining ground. Cosentyx (secukinumab) will enter the EU market in 2026, ahead of the U.S. And in 2028, Keytruda’s patent expires. That’s when the real test begins. Will biosimilars capture 65% of the market, as SVB Leerink predicts? Or will originator companies use legal tricks and rebate deals to hold on, as Evercore ISI warns? One thing’s certain: the era of sky-high prices for biologics is ending. The question isn’t if biosimilars will win. It’s how fast-and how fairly.Are biosimilars the same as generics?

No. Generics are exact chemical copies of small-molecule drugs. Biosimilars are highly similar versions of complex biological drugs made from living cells. They’re not identical, but they’re proven to have no clinically meaningful differences in safety or effectiveness. The approval process for biosimilars is far more complex and expensive than for generics.

Why are biosimilars cheaper than the original biologics?

Biosimilars cost less because they don’t need to repeat all the early clinical trials the original drug did. The manufacturer only needs to prove similarity, not re-prove safety from scratch. That cuts development costs by 50-70%. But they still require $150-250 million in investment and 7-10 years to bring to market. The savings come from reduced R&D, not lower quality.

Can I be switched to a biosimilar without my doctor’s approval?

In many U.S. states, yes-if the biosimilar is designated as “interchangeable” by the FDA. As of December 2025, 12 biosimilars have this status. Pharmacists can substitute them without consulting your doctor, just like with generics. But some states require notification, and some insurers still require prior authorization. Always check your state’s laws and your insurance plan.

What’s the biggest barrier to biosimilar adoption in the U.S.?

The biggest barrier isn’t science-it’s money. Medicare Part B reimburses providers based on the drug’s average sales price. So if a doctor gives a $10,000 brand-name drug, they get paid more than if they give a $7,000 biosimilar. That creates a financial incentive to stick with the original. Payers are trying to fix this with $0 copays for biosimilars, but the system is slow to change.

When will Keytruda biosimilars be available?

Keytruda’s core patent expires in 2028. Fourteen companies are already in Phase 3 trials. The first biosimilars could launch as early as late 2028, but legal challenges and patent disputes may delay some. Don’t expect widespread availability until 2029 or 2030. This will be the largest biosimilar entry in history, potentially saving the U.S. healthcare system tens of billions.

How do I know if I’m getting a biosimilar?

Check your prescription label. Biosimilars have a unique nonproprietary name that ends with a four-letter suffix (e.g., adalimumab-atto for an Humira biosimilar). Your pharmacy will also notify you if a substitution is made. If you’re unsure, ask your pharmacist or check the FDA’s Purple Book database, which lists all approved biosimilars and their interchangeability status.

Comments

Juan Reibelo

Wow. This is the kind of post that makes you realize how much we take medicine for granted. I had no idea biosimilars cost $250 million to develop. That’s more than most startups raise. And yet, they’re still cheaper? That’s wild.

My uncle’s on Humira. He switched to the biosimilar last year. Said he didn’t feel any difference, but his copay dropped from $400 to $45. That’s not a win-it’s a revolution.

Also, the part about Medicare paying more for the brand-name drug? That’s insane. It’s like rewarding doctors for being expensive. Someone’s making money off confusion.

And Keytruda? 237 patents? That’s not innovation-that’s legal warfare. I hope the FDA doesn’t get bullied into letting Merck stretch this out another decade.

Anyway, I’m just glad we’re finally getting some pressure on drug prices. It’s about time.

Kat Peterson

OMG I CRIED reading this 😭

Like… Keytruda is literally a MIRACLE DRUG. And now? Some big pharma company is gonna slap on a $500 version and call it ‘similar’???

What if it doesn’t work the same?? What if my cousin’s tumor comes back because some lab in South Korea messed up the glycosylation???

I’m not scared of biosimilars… I’m scared of the SYSTEM.

Also, who’s gonna pay for the lawsuits when someone dies? 😭😭😭

Himanshu Singh

Beautiful post. Truly. This isn’t just about drugs-it’s about justice.

Think about it: for decades, we let corporations charge $100K for a drug that costs $500 to make. Why? Because they could.

Now, biosimilars are forcing the hand of giants. Not with protests, not with petitions-but with science, patience, and billions in R&D.

It’s not about replacing the original. It’s about making the original’s legacy accessible.

And yes, the manufacturing hurdles? Real. The FDA’s scrutiny? Necessary. But the outcome? A win for humanity.

Let’s not fear change. Let’s guide it with care.

Jamie Hooper

so like… keytruda’s patent expires in 2028 right? but merck’s got 237 patents???

bro that’s not a patent thicket that’s a legal forest. like, who even reads all that? 😅

and the whole ‘reimbursement incentive’ thing? classic. docs get paid more to give the expensive one? so we’re punishing cost savings???

also-why is sandoz winning everything? they’re basically the biosimilar king now. like… who even is sandoz? i thought they were just the company that made the generic penicillin my grandad took

Husain Atther

The development of biosimilars represents a significant advancement in global healthcare equity. While the scientific rigor required is immense, the societal benefit is profound.

It is worth noting that in nations with centralized healthcare systems, biosimilar adoption has been both rapid and successful, indicating that regulatory and economic alignment can drive positive outcomes.

The United States, with its fragmented payer structure, faces structural challenges that are not necessarily scientific in nature.

Long-term outcome tracking across multiple biosimilar brands remains an area requiring coordinated investment in real-world data infrastructure.

One hopes that policy evolution will follow scientific progress, rather than lag behind it.

Helen Leite

EVERYTHING IS A LIE.

Did you know the FDA gets money from Big Pharma? 😳

They approved all these biosimilars because they’re paid off. You think they’d let a $200B market collapse unless they were in on it?

And those ‘interchangeable’ labels? That’s just the first step. Next thing you know, they’ll be putting biosimilars in your water.

Also, why do all the biosimilar companies have names like ‘Alvotech’ and ‘Coherus’? Sounds like sci-fi villains. 👁️👁️

They’re gonna swap your cancer drug for a lab-grown clone and you’ll never know. 😈

Izzy Hadala

While the economic implications of biosimilar market penetration are substantial, the analytical and clinical comparability frameworks remain inadequately standardized across jurisdictions.

The FDA’s 2025 draft guidance on ‘Analytical Similarity for Highly Complex Biologics’ represents a necessary but insufficient step toward harmonizing global regulatory expectations.

Further, the lack of longitudinal, multi-center pharmacovigilance databases limits the ability to detect rare immunogenicity events across biosimilar brands.

It is imperative that post-marketing surveillance protocols be standardized and publicly accessible to ensure patient safety.

Marlon Mentolaroc

Let’s be real: this is just pharma’s way of saying ‘we’re not evil, we’re just… cheaper evil.’

Merck made $25B off Keytruda. Now they’re gonna make $20B off biosimilars? And the rest of us are supposed to cheer?

And don’t get me started on the ‘interchangeable’ label. That’s just a fancy word for ‘we’re swapping your life-saving drug without telling you.’

Meanwhile, the people who actually make these drugs? They’re in South Korea, working 12-hour shifts in clean rooms. Nobody’s talking about them.

So yeah. Lower prices? Great. But let’s not pretend this is altruism.

Gina Beard

It’s not about the drug. It’s about who controls the narrative.

Pharma sells hope. Biosimilars sell savings.

Hope is more profitable.

Don Foster

Everyone’s acting like biosimilars are some kind of miracle but let’s be real they’re just generics with extra steps and higher prices

And don’t even get me started on that 237 patent thing that’s just corporate greed dressed up as innovation

Also the FDA is just a rubber stamp for Big Pharma anyway so who cares if they approve it

And why are we even talking about this like it’s new it’s been happening in Europe for a decade

US is always last to the party and then acts like it invented the cake

siva lingam

So we spent 10 years and $250M to make a copy that’s 30% cheaper

And the original drug costs $10K

So the math is… we’re all just paying for the drama

Also who even reads this whole thing

tbh i just scrolled to the part where it said ‘Keytruda’

Shanta Blank

THIS IS A SLOW-MOTION CAR CRASH AND WE’RE ALL IN THE BACK SEAT HOLDING SNACKS.

Keytruda’s patent expires in 2028? Nah. It’s gonna be 2032. Merck’s got lawyers on speed dial and a team of patent wizards who write claims like Shakespearean sonnets.

And the biosimilars? They’re gonna be released in dribs and drabs-just enough to keep the hype alive but not enough to actually slash prices.

Meanwhile, hospitals are still getting paid more to give the $10K drug. So guess what? They’re gonna keep giving it.

And patients? They’ll get confused, scared, and then quietly switched without knowing.

This isn’t progress.

This is capitalism with a nice website.