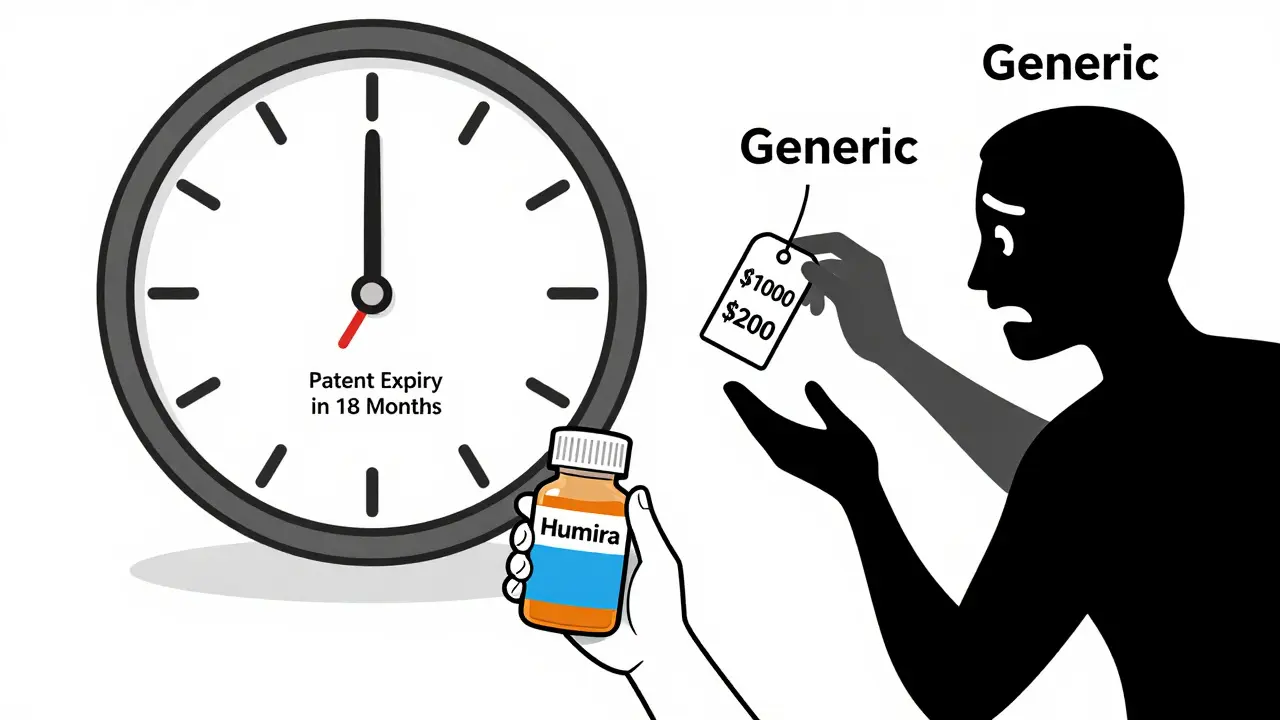

When a drug’s patent runs out, prices don’t just drop-they plummet. For patients on long-term medications, this can mean paying 80% less. For hospitals and insurers, it’s a chance to save millions. But none of this happens automatically. If you’re a patient on a brand-name drug like Humira, Enbrel, or Lipitor, or if you manage care for a health system, you need to act before the patent expires-usually two years before.

Why Patent Expiry Isn’t Just a Date on a Calendar

Pharmaceutical patents last 20 years from the date they’re filed. But by the time a drug hits the market, five to eight years have already passed in clinical trials and FDA review. That leaves only 7-10 years of real market exclusivity. Companies know this. So they don’t just rely on the original patent. They file dozens of secondary patents-on new formulations, delivery methods, dosages, or even minor chemical tweaks. This is called a “patent thicket.” For example, a single drug like Humira had over 100 patents filed around it. Some were for new injection pens. Others for different dosing schedules. Each one delayed generic entry. Even after the main patent expired, these secondary protections kept prices high. In 2023, the FTC reported a 35% drop in “pay-for-delay” deals-where brand companies pay generics to stay off the market-but they still happen. And in the U.S., they’re still costing patients $13 billion a year.What Happens When the Patent Expires?

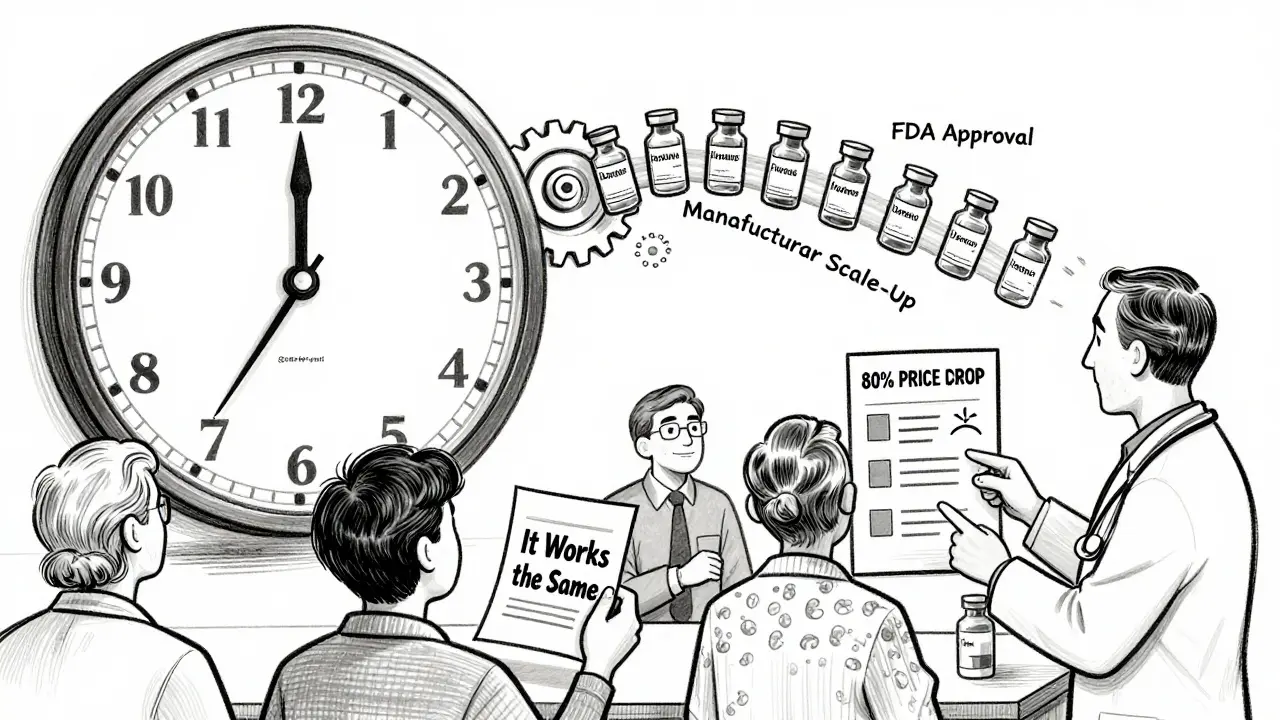

Once a patent expires, generic manufacturers can legally sell the same drug. In most cases, the generic version is 80-85% cheaper within a year. But it’s not that simple. - For small-molecule drugs (like statins, blood pressure meds, or antidepressants), generic versions enter fast. Within 12 months, 90% of prescriptions switch to generics. Prices drop to 10-20% of the original cost. - For biologics (like insulin, rheumatoid arthritis drugs, or cancer treatments), it’s different. These are complex proteins made in living cells. They can’t be copied exactly-only closely replicated. These copies are called biosimilars. They take longer to develop, cost more to make, and face more resistance from doctors and patients. Only 38% of biologic prescriptions switch to biosimilars within two years. Prices drop only 20-40% initially. And here’s the catch: just because a generic is approved doesn’t mean it’s available. Supply chains get disrupted. Manufacturers struggle to scale up. In 2023, 65% of hospital pharmacy directors reported drug shortages in the first six months after a patent expired.What Patients Should Do

If you’re taking a brand-name drug, here’s what you need to know:- Check if your drug is due to lose patent protection. Sites like Drugs.com or the FDA’s Orange Book list upcoming expirations. Look up your medication and see if there’s a “patent expiration” date listed.

- Ask your pharmacist or doctor: “Is a generic or biosimilar coming soon?” Don’t wait for them to bring it up.

- Don’t assume all generics are the same. Some have different inactive ingredients-fillers, dyes, preservatives-that can cause side effects. If you feel worse after switching, tell your doctor. It’s not “all in your head.” A 2022 Kaiser survey found 37% of patients reported new side effects after switching to generics-even though they met FDA bioequivalence standards (80-125% absorption).

- Ask about cost. Even before the patent expires, some insurers start moving patients to cheaper alternatives. If your copay jumps unexpectedly, ask why. It might be a formulary change.

- If you’re on Medicare Part D, watch for formulary changes. In 2022, 42% of beneficiaries were switched to a different drug after patent expiry. Some got a generic. Others got a different brand. Ask for a copy of your plan’s formulary update.

What Healthcare Systems Must Plan For

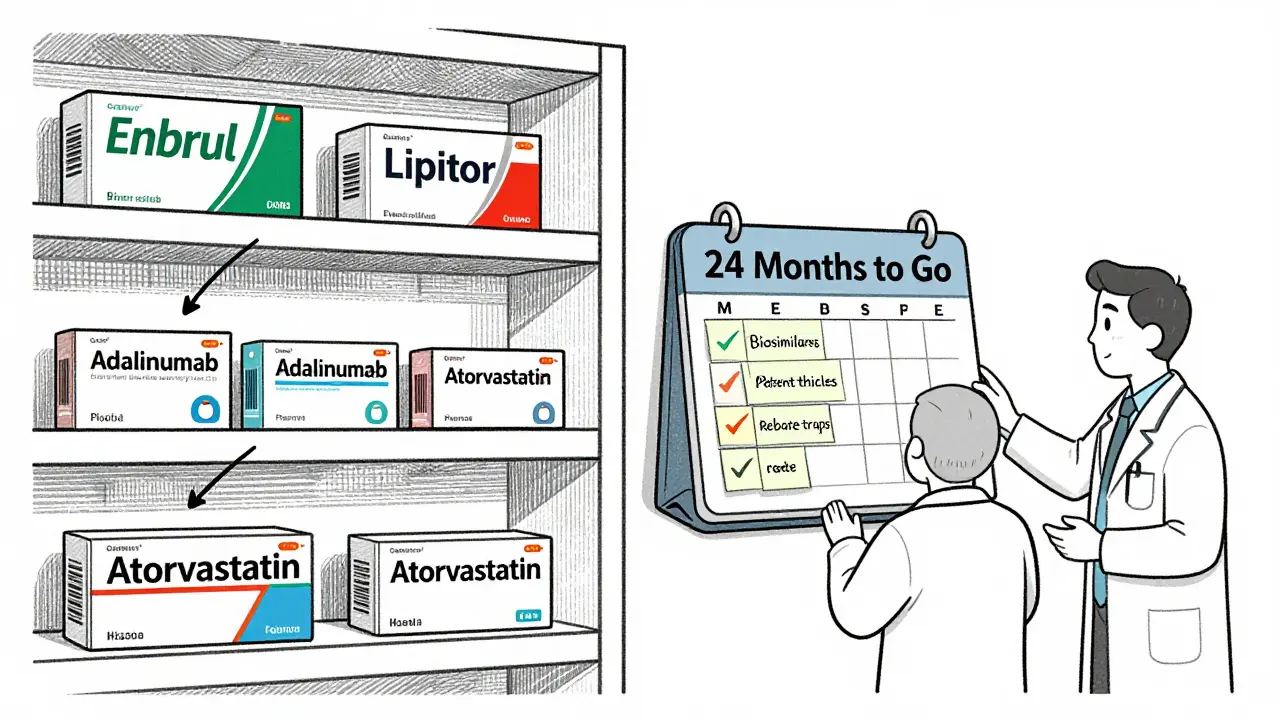

Hospitals, insurers, and clinics face a massive logistical challenge. In the U.S. alone, over 1,400 patent expirations happen every year. Planning for them is not optional-it’s financial survival. Successful systems start planning 24 months before the patent expires. Here’s how:- Track expirations. Use tools like Symphony Health’s PatentSight or similar platforms. These track every patent, extension, and legal challenge. Don’t rely on outdated lists.

- Build a cross-functional team. Include pharmacists, clinicians, finance staff, and contract negotiators. If you’re a small clinic, assign one person to monitor this. But don’t ignore it.

- Forecast savings. Don’t just look at the list price. Look at net price after rebates. In the U.S., brand-name drugs often have huge rebates paid to pharmacy benefit managers (PBMs). When generics enter, those rebates disappear. The real savings come from the lower wholesale cost, not the list price drop.

- Update formularies 12 months out. Decide which generic or biosimilar to prefer. Will you allow multiple? Will you require prior authorization? Write clinical guidelines so doctors know what to prescribe.

- Prepare for patient confusion. Create simple handouts or videos. Explain: “This drug is now available as a cheaper generic. It works the same way. Here’s what to watch for.”

- Negotiate with suppliers. Start talks with generic manufacturers early. Lock in pricing before competition heats up. The first 90 days after entry are the cheapest.

Why Some Drugs Don’t Get Cheaper-Even After Patent Expiry

Not every drug becomes affordable after patent expiry. Here’s why:- Patent extensions. Companies can get extra protection through “Supplementary Protection Certificates” (SPCs) in Europe or “patent term restoration” in the U.S. for drugs that took longer to approve.

- Product hopping. A company stops selling the old version and pushes patients to a new, slightly different version-often with a new patent. This is called “evergreening.” The 2023 CREATES Act cracked down on this, but it still happens.

- Rebate traps. Brand companies pay PBMs large rebates to keep their drug on the formulary. Even after generics are available, the brand stays on because the rebate makes it “cheaper” on paper-even if the patient pays more out of pocket.

- Physician resistance. Many doctors still believe generics are less effective. A 2022 AMA survey found 62% of physicians expressed concerns about switching to generics, especially for psychiatric or epilepsy drugs.

What’s Changing in 2025-2026

The rules are shifting. The Inflation Reduction Act of 2022 lets Medicare negotiate prices for 10 drugs in 2026. These will be drugs that lost patent protection at least 9 years ago. That means the first wave of negotiations will hit drugs like Eliquis, Xarelto, and Farxiga. Also, the FDA’s GDUFA III rules are speeding up approval of complex generics. That could cut the time from patent expiry to generic availability from 18 months to 12. And biosimilars? They’re getting better. By 2028, IQVIA predicts biosimilars will capture 45% of the biologics market-up from 27% today. That’s $150 billion in savings.What You Can Do Today

You don’t need to wait for a patent to expire to save money. Start now:- Check your prescription list. Look up each drug on Drugs.com or the FDA’s Orange Book. See if any are due to expire in the next 18-24 months.

- Call your pharmacy. Ask: “Is there a generic coming for this?”

- If you’re on a chronic medication, ask your doctor if you can switch to a generic now-even before the patent expires. Some insurers allow it early.

- For systems: Start a patent expiry tracker. Even a simple spreadsheet with drug names, expiration dates, and estimated savings can make a difference.

Comments

Corey Chrisinger

This is wild. I’ve been on Humira for 8 years. My copay dropped from $500 to $40 last month. I didn’t even know what was happening until my pharmacist slid me a pamphlet. 🤯 Life-changing. Why isn’t this common knowledge?

Christina Bilotti

Oh wow. Another ‘wake up and smell the generics’ post. Did you also learn that water is wet and the sky is blue? 🙄 Most people don’t care until their insurance screws them over. And no, ‘checking Drugs.com’ isn’t a strategy-it’s a cry for help.

brooke wright

I switched to a generic for my antidepressant last year and started having panic attacks at 3 a.m. I told my doctor, ‘It’s not me, it’s the pill.’ They laughed. Then I Googled it. Turns out, the filler in the generic had a weird dye. I went back. My anxiety is better now. Don’t assume it’s ‘all in your head.’

vivek kumar

The systemic failure here is not just corporate greed-it’s the collapse of patient education. In India, we have generics available within weeks of patent expiry. Why? Because the government mandates it. In the U.S., patients are left to Google while PBMs pocket rebates. This is not healthcare. It’s financial warfare.

Nick Cole

I work in a community clinic. We started tracking expirations 2 years ago. We saved $1.2M last year just on 3 drugs. The real win? Patients stopped skipping doses because they could afford them. This isn’t about cost-cutting. It’s about dignity.

Henry Ip

Check your meds now. Seriously. Just open your pill bottle and Google the name + patent expiry. Takes 2 minutes. If something’s expiring soon, call your pharmacy and ask if they have the generic ready. Do it before your next refill. You’ll thank yourself later

waneta rozwan

I cried when my insulin biosimilar came in. Not because it was cheaper-though $25 vs $300 is wild-but because I finally felt like a person, not a balance sheet. My doctor didn’t even tell me it was coming. I found out from a Reddit thread. That’s the system we live in.

Nicholas Gabriel

Wait-so you’re telling me that if I’m on a biologic, I might not get a biosimilar for two years? And even then, doctors won’t prescribe it? And patients are scared to switch? And the brand still gets rebates? And the patient pays more? And we call this ‘healthcare’? I need to lie down. 🤕

Cheryl Griffith

I’m a nurse. I’ve seen patients choose between insulin and rent. I’ve seen them split pills. I’ve seen them cry in the pharmacy because their copay doubled. This isn’t policy. This is survival. Please, if you’re reading this-tell someone. Tell your cousin. Tell your neighbor. Tell your boss.

Kasey Summerer

The U.S. health system is like a Netflix subscription where you pay $100/month for the show, then get charged $50 extra for the remote, $30 for the couch, and $20 to turn it on. And the company owns the remote. 😅

Samyak Shertok

Oh please. The real problem isn’t patents-it’s capitalism. You think generics are the answer? Nah. They’ll just get bought by the same Big Pharma conglomerates and priced at $199.99. It’s all a game. The system is rigged. We’re just rearranging deck chairs on the Titanic while the CEOs take their private jets to Bermuda.

Stephen Tulloch

I’m Canadian. We get generics in 3 months. No one cries. No one Googles. No one gets billed $400 for a pill. We just... get it. The U.S. doesn’t have a drug problem. It has a moral problem.

Joie Cregin

I used to think generics were ‘cheap knockoffs.’ Then I got on one for my blood pressure. Same results. No side effects. Saved $300/month. Now I’m like a total generic evangelist. Like, I even tell my grandma to ask for it. She calls me ‘the pill whisperer.’ 🌿💙

evelyn wellding

YOU CAN DO THIS. Start today. Open your meds. Google. Call your pharmacy. Save money. Save your peace. You got this. 💪❤️