When you pick up a bottle of generic medication at the pharmacy, you might assume it’s made by a different company altogether - maybe a name you’ve never heard of, like Teva or Mylan. But here’s the twist: authorized generics are often made by the very same company that makes the brand-name drug you’re used to. And that changes everything about how you think about generics.

What Exactly Is an Authorized Generic?

An authorized generic isn’t just another generic drug. It’s the exact same pill, capsule, or injection as the brand-name version - same active ingredient, same strength, same manufacturing process, same factory floor. The only difference? The label. No brand name. No fancy packaging. Just a plain box with the drug’s chemical name and a price that’s usually 20-50% lower.

The FDA defines it clearly: an authorized generic is a drug approved under the original brand’s New Drug Application (NDA), but sold under a private label. That means it skips the Abbreviated New Drug Application (ANDA) process entirely. No extra bioequivalence studies. No separate approval. Just the same product, repackaged.

This isn’t a loophole. It’s a legal pathway created by the Hatch-Waxman Act of 1984. The idea was to let brand-name companies compete with generics without giving up control over quality. And it’s worked - with 217 authorized generics on the U.S. market as of late 2023, making up about 7.3% of all generic drugs sold.

Who’s Really Behind the Label?

There are three main ways authorized generics get made - and who makes them depends on the strategy of the brand company.

1. The Brand Company Itself

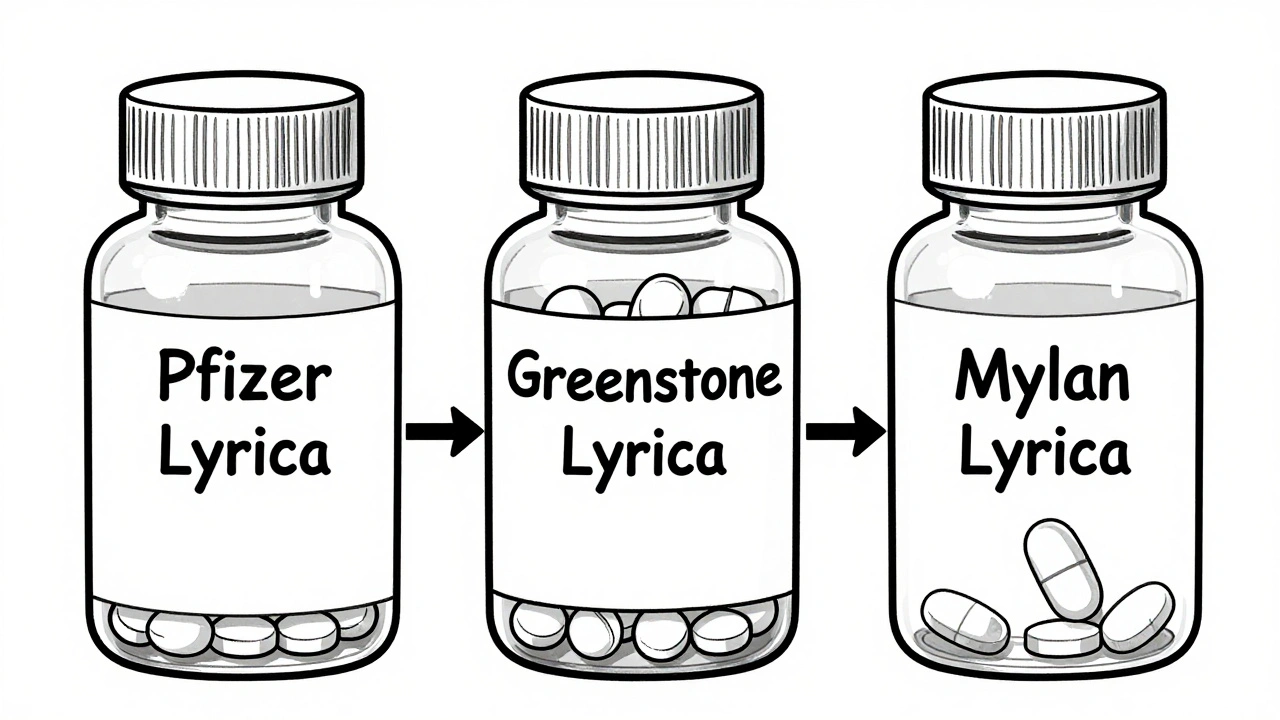

About 52% of authorized generics are made directly by the original manufacturer. They simply run the same production line, then slap on a plain label. Pfizer does this through its subsidiary Greenstone LLC, which has been making authorized generics since 1998. Greenstone doesn’t have its own R&D or patents - it’s just Pfizer’s vehicle for selling the same drugs at generic prices. Same pills. Same factory. Same quality control.

2. A Wholly-Owned Subsidiary

Some companies create dedicated arms for authorized generics. AstraZeneca’s Az generici is one example. It’s not a separate company in the way Teva is - it’s a legal entity owned entirely by AstraZeneca, set up to handle the authorized generic version of Nexium. In 2022, that single product brought in $1.2 billion in sales. That’s more than most independent generic manufacturers make in a year.

3. A Third-Party Contract Manufacturer

About 17% of authorized generics are outsourced. But here’s the catch: the brand company still owns the NDA. They don’t just hand off the recipe. They require the contract manufacturer to use the exact same active ingredient, same equipment, same testing protocols, and same facility standards. Novartis did this with Comtan, using a third-party plant but insisting every step matched the original. The FDA still holds Novartis fully responsible.

That’s the biggest myth busted: authorized generics aren’t made by random generic companies. They’re made under the watchful eye of the brand manufacturer - often in the same building, with the same workers, using the same machines.

Why Does This Matter?

Most people think generics are cheaper because they’re made cheaper. But that’s not always true. Traditional generics often come from overseas factories with lower labor costs, different equipment, and sometimes less oversight. Authorized generics? They’re made in the same U.S.-based, FDA-inspected facilities as the brand-name drug.

The FDA’s 2022 inspection data showed authorized generic facilities had a 98.7% compliance rate with current Good Manufacturing Practices (cGMP). Traditional generic manufacturers? 96.2%. That’s not a huge gap - but in pharma, even 2.5% matters. It means fewer recalls, fewer batch failures, fewer safety issues.

And then there’s consistency. If you’ve been on a brand-name drug for years and your doctor switches you to a generic, you might notice a difference - even if it’s just in the size of the pill or how it dissolves. With an authorized generic? You won’t. Because it’s the same thing.

Therapeutic Areas Where Authorized Generics Dominate

Not all drugs get authorized generics. They’re most common where the brand company has a lot to lose - and a lot to gain.

- Cardiovascular drugs (28%) - Think blood pressure meds like lisinopril or statins like atorvastatin. These are taken daily for life. Patients and doctors want reliability.

- Central nervous system drugs (22%) - Antidepressants, anticonvulsants, Parkinson’s meds. Even tiny variations in absorption can cause side effects or relapse.

- Metabolic agents (18%) - Diabetes drugs like metformin or GLP-1 agonists. These are high-cost, high-demand medications where price sensitivity is fierce.

One of the most famous cases? Lyrica. When Pfizer’s patent neared expiration, Mylan (now Viatris) stepped in to make the authorized generic - under Pfizer’s NDA. That meant patients got the same formulation, same purity, same stability profile. No surprises.

The Controversy: Are Authorized Generics Helping or Hurting?

It’s not all smooth sailing. Critics say authorized generics are a clever trick to delay real competition.

Dr. Aaron Kesselheim from Harvard published a 2021 study in JAMA Internal Medicine arguing that when a brand company launches its own generic, it scares off other generic manufacturers. Why invest in an ANDA if the brand’s version is already on the shelf at a lower price? The result? Fewer competitors. Less price pressure. Higher overall costs over time.

The FDA acknowledges this. In their 2023 Transparency Initiative, they admitted that authorized generics can reduce market entry by independent generics. But they also point out: “AGs have identical active ingredients, strength, dosage form, and route of administration as the brand-name drug.” And that’s the point. If you’re a patient, you get the same drug - just cheaper.

Industry analysts at IQVIA estimate authorized generics now make up $4.7 billion in annual U.S. sales. That’s 9.2% of the total generic market - up from 6.1% in 2018. And with over $127 billion in brand-name drugs set to lose patent protection by 2030, that number is only going up.

What’s Changing in 2025?

The FDA just made a big move. Starting January 1, 2024, manufacturers must disclose whether an authorized generic is made in the same facility as the brand-name version. This is a direct response to the Government Accountability Office’s 2022 report on supply chain opacity.

Why? Because patients and pharmacists deserve to know. If you’re switching from a brand to a generic, you should be able to tell if it’s truly the same product - or just a copy made elsewhere.

One of the biggest upcoming cases? Humira. AbbVie has already lined up its subsidiary Soliris Generics to produce the authorized generic version as soon as the patent expires. This isn’t speculation - it’s in their SEC filings. They’re not waiting. They’re preparing.

What This Means for You

If you’re on a brand-name drug and your insurance switches you to a generic, ask: Is this an authorized generic? It’s not always obvious on the label. But your pharmacist can check. If it is, you’re getting the same drug - just without the brand markup.

For patients with chronic conditions, that consistency matters. No new side effects. No unexpected dosing changes. Just lower cost.

And if you’re wondering why your generic looks different from last time? That’s normal. But if it’s an authorized generic, the difference is just the label - not the medicine inside.

The bottom line? Authorized generics aren’t a compromise. They’re a continuation - of quality, of safety, of trust. And the company that made the brand? They’re still the one making the generic. You just didn’t know it.

Comments

Louis Llaine

So let me get this straight - the same company that charges $500 for a pill makes the exact same pill for $10 and calls it a ‘generic’? Brilliant. Just brilliant. 🤡

Next they’ll sell me the same coffee beans in a ‘budget’ bag and call it ‘artisanal decaf lite’.

Kyle Oksten

This isn’t just about pricing - it’s about trust in the system. When the brand manufacturer controls the entire supply chain, even for the ‘generic’ version, you’re not getting competition - you’re getting a controlled simulacrum.

Real generic markets force innovation and cost reduction. This? This is regulatory arbitrage dressed up as consumer benefit. The FDA’s compliance stats are misleading - same facility doesn’t mean same oversight culture. The incentive structure is still broken.

And yet… if you’re diabetic and need metformin every day, do you really want to gamble on a foreign factory’s batch variation? Maybe this is the lesser evil. But we shouldn’t call it progress.

Sam Mathew Cheriyan

wait wait wait… so u mean big pharma is secretly making the cheap pills too?? 😳

they been lying to us this whole time??

imagine if the same people who made your adderall also made the ‘generic’ one but called it ‘lil’ adder’ and sold it for $2…

they prob got a secret room in the factory where they make the real stuff and the fake stuff side by side…

and the FDA just lets them do it??

im scared now 😭

Ernie Blevins

Big pharma is just milking the system. They don’t care about you. They care about profit.

They make the drug. They own the patent. They make the ‘generic.’ They get paid twice.

It’s a scam. You’re not saving money. You’re just paying them differently.

And you’re dumb if you think this is about ‘quality.’ It’s about control.

End of story.

Nancy Carlsen

This actually made me feel so much better about my meds! 💕

I’ve been on lisinopril for 5 years and always worried the generic was ‘weaker’ or ‘different’ - but knowing it’s the same pill, same factory, same people handling it? That’s a relief.

Thank you for explaining this so clearly! 🙏

PS: Ask your pharmacist next time - they can tell you if it’s an authorized generic! You’re worth the same quality, no matter the label! 🌈

Jennifer Anderson

soooo… if its the same thing why do they even bother with the label change? 🤔

like if its literally identical why not just sell it as the brand but cheaper?

maybe theyre scared people will think its the same and then they cant charge full price later?

also my pharmacist said some of these are made in the same building but different shifts… is that true??

just trying to understand 😅

Kyle Flores

Reading this reminded me of my mom’s experience with her antidepressant. She switched from the brand to a generic and had a panic attack - not because the drug didn’t work, but because she *felt* different.

Turns out it was an authorized generic. Same exact thing. Just the pill shape was slightly different. She didn’t know that.

That’s the real issue here: transparency. We need labels that say ‘Made in same facility as [Brand Name]’ - not just ‘generic.’

Patients deserve to know. Not just pharmacists. Not just doctors. Us.

Thanks for writing this. It’s the kind of info that saves people from unnecessary fear.

Ryan Sullivan

Authorized generics represent a classic case of regulatory capture disguised as market efficiency. The Hatch-Waxman Act, intended to foster competition, has been weaponized by vertically integrated pharmaceutical conglomerates to suppress independent generic entrants under the guise of ‘quality assurance.’

The 98.7% cGMP compliance statistic is statistically insignificant when contextualized against the oligopolistic structure of the generic supply chain - where 3 firms control 72% of the market.

The FDA’s 2024 disclosure mandate is performative. It does not address the core issue: the absence of true market entry. When the incumbent manufactures the ‘alternative,’ you don’t have competition - you have monopolistic pricing in a second-tier label.

Until Congress amends the ANDA framework to prohibit NDA holders from producing authorized generics, this is not pharmaceutical innovation - it is rent extraction.