PBM Pricing Practices: How Pharmacy Benefit Managers Control Your Drug Costs

When you pick up a prescription, you might think the price comes straight from the drugmaker. But behind the scenes, PBM pricing practices, the hidden rules pharmacy benefit managers use to set drug prices and manage coverage. Also known as pharmacy benefit managers, these companies act as middlemen between drug makers, insurers, and pharmacies—and they control how much you pay. PBMs don’t make drugs, but they decide which ones get covered, at what price, and who gets access. Their decisions ripple through your co-pay, your insurance deductible, and even whether your doctor can prescribe the medication you need.

PBM pricing practices rely on formulary management, the process of selecting which drugs are covered under a health plan. Also known as drug lists, these formularies aren’t based solely on medical effectiveness—they’re shaped by rebates, discounts, and secret deals between PBMs and drug manufacturers. A drug might be placed on a higher tier not because it’s riskier, but because the manufacturer paid more to the PBM. This is why two people with the same insurance can pay wildly different prices for the same pill. And when PBMs negotiate rebates, those savings don’t always reach you. Often, they go straight to the insurer or stay with the PBM as profit.

Then there’s the spread pricing, the difference between what the PBM charges the insurer and what it pays the pharmacy. Also known as price markup, this practice lets PBMs pocket the gap. If your plan pays $100 for a drug, but the PBM only pays the pharmacy $60, the $40 difference is spread pricing—and you might still be charged the full $100 based on your co-pay structure. It’s legal, but rarely transparent. Many patients don’t realize they’re paying more than the pharmacy actually received.

These practices show up in real ways. A patient on insulin might be told their plan covers it, but their co-pay is $300 because the PBM placed it on a specialty tier. Another person gets a generic version that’s cheaper—but only because the PBM pushed it into the formulary after getting a rebate from the maker. Meanwhile, older drugs that don’t offer big rebates get pushed out, even if they work fine. This isn’t about clinical need. It’s about money flowing through the system.

What you’ll find in the posts below are real stories and breakdowns of how these systems actually work. From how drug labels hide PBM influence, to how patient assistance programs get caught in the middle of these pricing games, to how insurers and PBMs shape what medications are even available to you. You’ll see how PBM pricing practices affect everything from diabetes meds to chemotherapy drugs, and why knowing how these deals work can help you ask better questions and avoid overpaying.

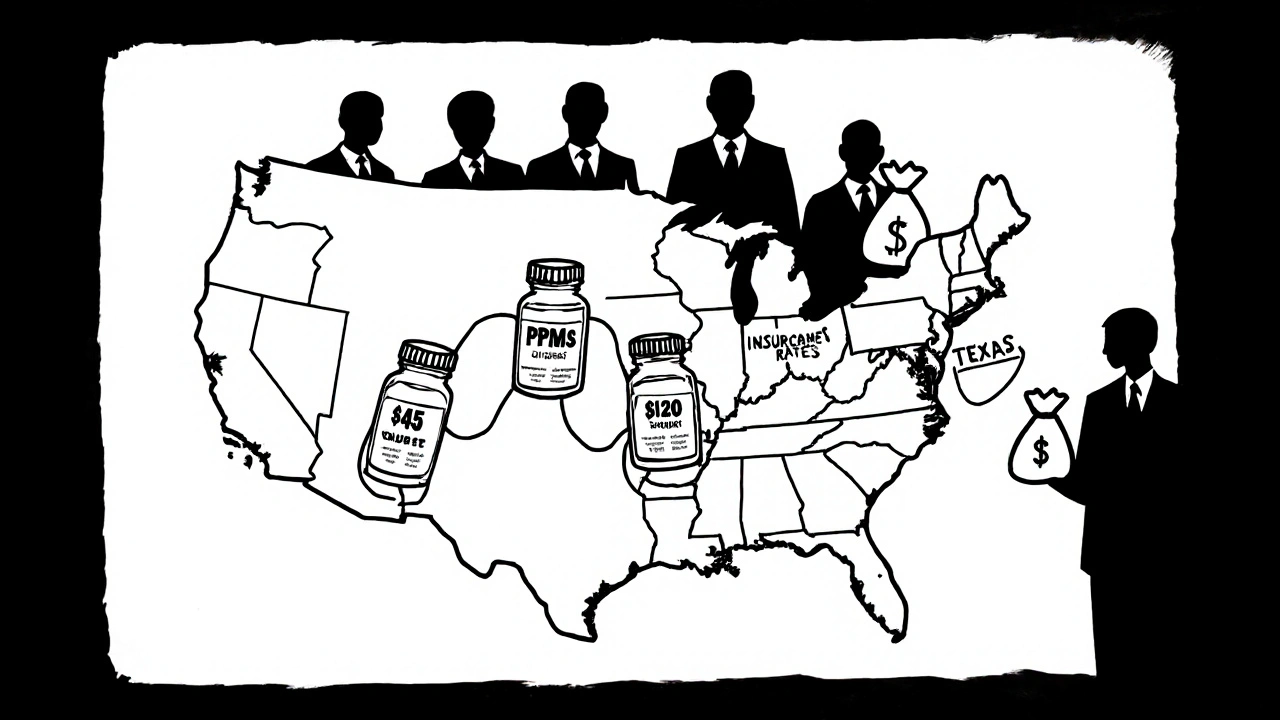

Why Generic Drug Prices Vary by State: The Real Reasons Behind Geographic Pricing Differences

Generic drug prices vary by state due to PBM practices, Medicaid rules, and pharmacy competition. Learn why the same pill costs $120 in Texas and $45 in California-and how to pay less no matter where you live.

read more